Below is a transcript of his video and here is a link to the full video explanation.

Welcome National Indoor RV Center’s family of customers and friends to RVs, the Economy and You! UPDATE #2, Part Three.

In Part Three. I want to share my thoughts and question the logic of the following three statements I am repeatedly keep getting asked, and I keep reading about on the forums:

1. I’m going to wait for the price of fuel to come down before purchasing a coach.

2. I’m going to wait for the price of coaches to come down before buying.

3. I’m going wait and buy a used coach for cheap when all these COVID buyers discovery they made a mistake, and want to get out.

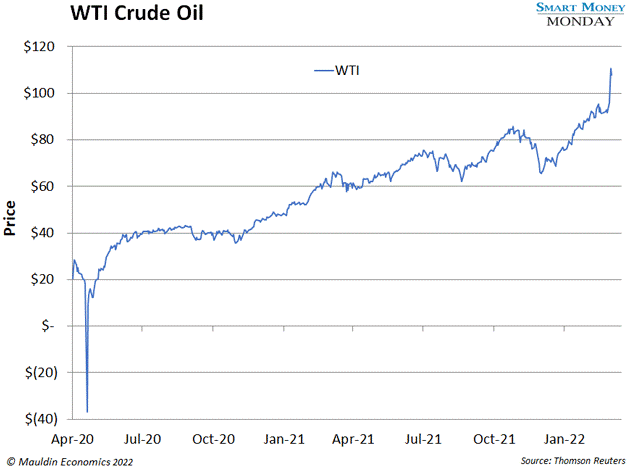

Personally, I don’t believe oil will drop below $100 per barrel anytime soon. Yes, oil spiked reaching an 8 year high, and everyone is pointing to Russia’s invasion of Ukraine. It makes sense. Russia is the world’s third largest producer of oil, and the top exporter to global markets. Russia produced 12% of the world’s oil last year, with 60% of its oil going to Europe. Now the west is refusing to do business with Russia, which crimps supply, hence the recent spike. But, if we zoom out we see prices have been on a choppy upward march since April of 2020.

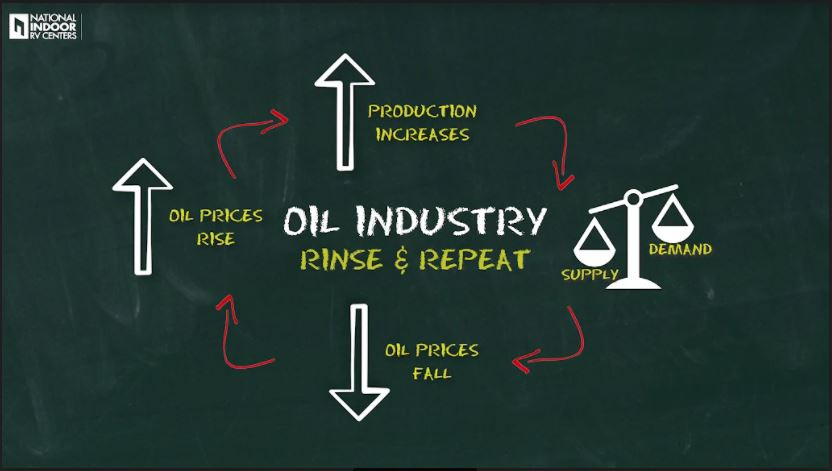

As I previously mentioned, I believe $100 plus oil is here to stay for awhile, and it’s not just because of Russia. The oil industry runs in cycles. When oil prices rise, production increases, supply exceeds demand, and then prices fall. Rinse and repeat. As the saying goes, the cure for high prices is high prices.

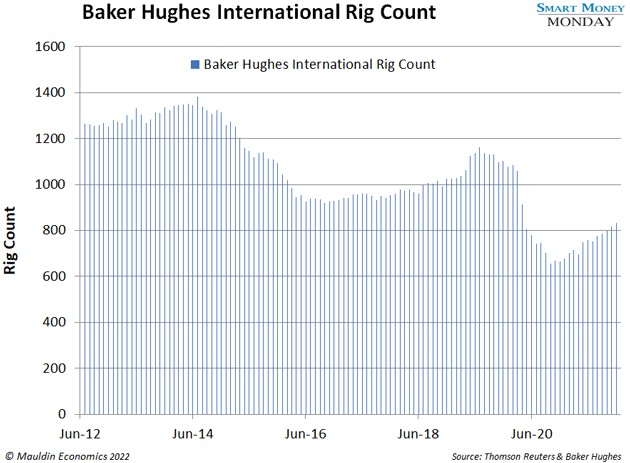

The problem is production hasn’t increased much this time around. One of the best indicators of oil production is the Baker Hughes international rig count, which measures the number of active drilling rigs around the world.

As you can see from this chart, the rig count is currently hovering around 840. That’s 38% lower than the 10-year peak of 1,350. The last time we saw $100 per barrel it lasted 41 months from March of 2011 to August 2014, and the mood was “drill baby drill.”

Today the mood is different. Everyone’s looking to green energy, and the oil producers have no plans to ramp up production. Their spending plans changed after the last bear market in oil. Instead of plowing money into exploration and production, they’re returning cash back to their shareholders through dividends and share repurchases. BP, Exxon, and Chevron plan to spend between $38 and $41 billion in share buybacks just this year alone. That’s one whale of a lot of money not going into exploration and production this year!

Now turning to demand, I realize there are some who say we won’t even need oil in the future. But, that future isn’t coming tomorrow. By way of full disclosure, I live full time in, and drive a coach that gets 7 miles per gallon of diesel. In an attempt to balance out my carbon footprint, I also drive a Tesla. So, I am a fan, and a consumer of both a diesel powered coach, and an electric vehicle. And, I love both of them equally, but realistically oil is not going away in my lifetime.

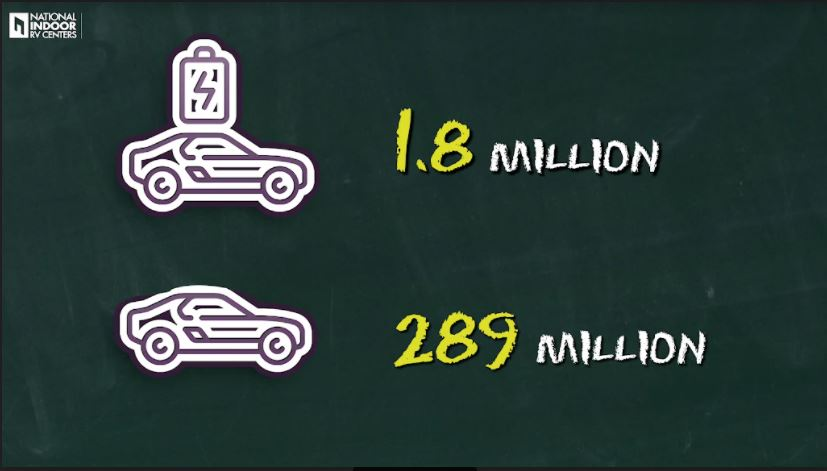

There are currently 1.8 million electric vehicles registered in the United States today versus 289 million registered cars. Electric vehicles make up a little over one half of one percent of all the passenger vehicles on the road today. Even if electric vehicles grew to 5% of the passenger market, which will happen someday, it still won’t dampen oil demand by much. And remember, we haven’t even mentioned the oil consumption for commercial trucking, busing, airlines and so on.

I don’t believe coach owners will stop using, or purchasing coaches because of fuel prices. I believe they will once again do what I did as coach owner, and what I observed our customers did the last time fuel prices were high. They will still take just as many trips, but those trips will be in-state, or to a neighboring state, instead of the cross country trips they enjoyed when fuel prices were low. Instead of traveling to, and staying in several resorts, or parks on a trip, they will simply stay longer, and visit fewer resorts on the same trip. Or, they will simply hedge the cost of their fuel by investing in oil stocks, and let their stock gains more than offset the increase in the cost of their fuel. What they didn’t do, and what I don’t intend to do, is to stop living the lifestyle, or put off purchasing a coach because of fuel prices. Time will tell if history repeats itself this time around or not I guess.

Turning to the question of waiting for coach prices to come back down. Now, here I do have a couple of thoughts, and the first one is, I don’t believe the prices of new coaches will come down. In fact, I believe the price of new coaches will continue to go up.

Coach manufacturers are really what I term to be “parts assemblers.” And, I just don’t see the cost of all the parts, components, and raw materials they use to assemble a coach coming down in price.

First, there is an awful lot of labor involved to manufacturer every part, and component used in the assembly of a coach, and then more labor to design, engineer, and assemble the coach. For the reasons I previously discussed in my RVs, the Economy, and You! UPDATE #2, Part Two video, I can only see the cost of labor going up, and there’s not a swinging thing anyone can do about it. The problem with labor shortages was baked in long time ago when our birth rates, and immigration rates started declining. Basically, when we stopped replacing ourselves.

Now from tires, to plastics, to shipping, there is a lot of fuel and petroleum based components and materials used in the assembly of a coach. And, for the reasons I just discussed a moment ago, I don’t see the cost of oil coming down anytime soon.

Bottom line, in absolute dollars, I don’t see the price of new coaches coming down. Rather, I see the rate of price increases, the rate of inflation if you will, slowing down as the supply chain sorts itself out, production rises to meet demand, and higher prices tamp down demand. But, I really don’t believe I will see a lower invoices on new Dutch Stars going forward.

Now for my second thought. Whether you are still working, or you’re retired living off your portfolio, coaches are more affordable today than they were 5 years ago. Please, before you scoff, and stop watching, allow me to explain why.

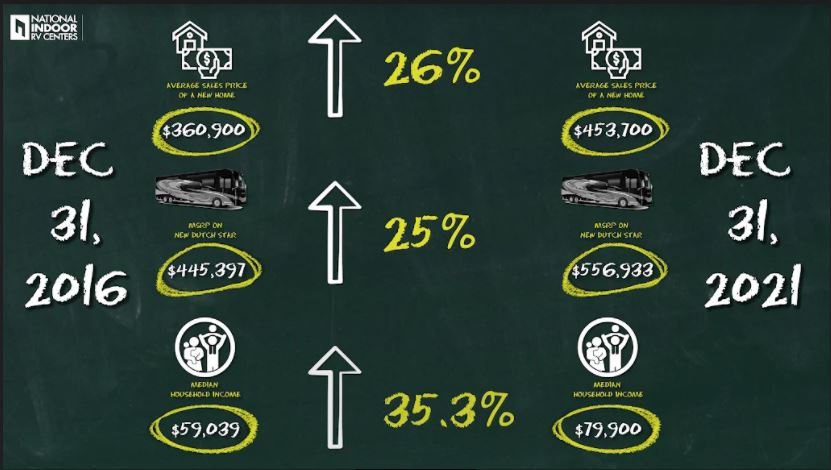

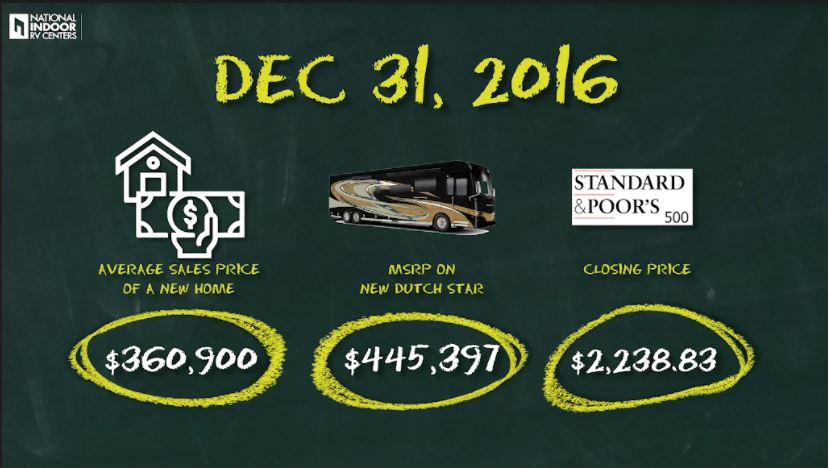

Let’s look at this in relative, and not absolute terms. At 12/31/2016 the median household income was $59,039, the average sales price of a new home was $360,900, and MSRP on a new Dutch Star was $445,397.

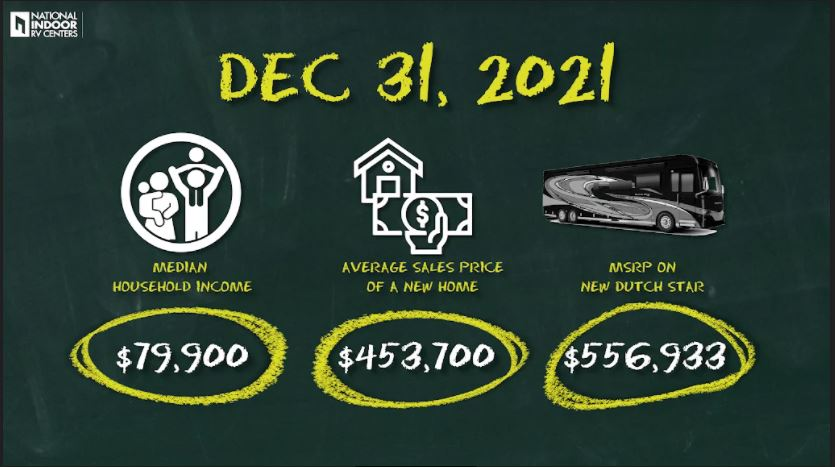

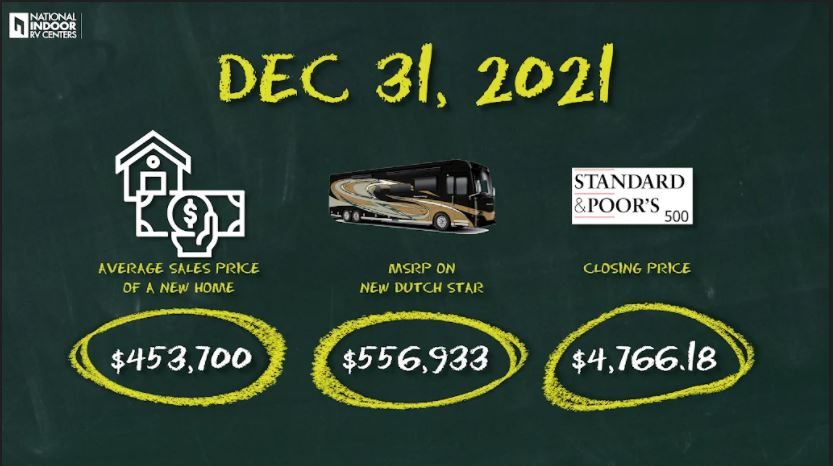

Now, let’s take a look at these same data points at 12/31/2021, or just 5 years later. The US Department of Housing and Urban Development estimates the median household income was $79,900, the average sales price of a new home was $453,700, and MSRP on a new Dutch Star was $556,933.

In relative terms, a new home on 12/31/16 cost 6.11 times the median household income, and the Dutch Star’s MSRP was 7.54 times the median household income.

By 12/31/2021 a new home costs 5.68 times the median household income, and the Dutch Star’s MSRP was 6.97 times the median household income.

How can this be? Well, the sales price of a new home went up 26%, the MSRP of a Dutch Star went up 25%, and the median household income went up 35.3%. Not with standing all the price increases, “Stuff” is more affordable today than it was 5 years ago because wages, or as an employer, labor is rising faster than either goods or services right now. How much of this increase in median household income is due the government’s monetary policies, and how much is due to the shortages in labor those policies created, remains to be seen. But, one thing is for sure, with a shrinking pool of labor going forward, wages are going to continue to go up.

It would be irresponsible of me not to point out the obvious, which is no one pays MSRP for a new coach. Ever! I trust and hope all of you know I’m restricted and only permitted to discuss MSRPs, and not disclose invoice amounts. But, the manufacturer’s markup from invoice to MSRP hasn’t changed over those five years, so the rate of inflation for a Dutch Star is accurate. We are still talking “apples to apples” when compared to the rate of inflation for houses, and household incomes.

Now, not everyone is still working. Many of you are retired, so this comparison of prices to household incomes is irrelevant to you. So, let’s take a look at housing, and coach prices relative to your investment portfolios.

At 12/31/2016 the average sales price of a new home was still $360,900 as previously mentioned, and MSRP on a new Dutch Star was still $445,397. And, the S&P 500 closed at 2,238.83.

5 years later on 12/31/21 the average sales price of a new home was still $453,700, and MSRP on a new Dutch Star was still $556,933, and the S&P 500 closed at 4,766.18.

Again, in relative terms a new home on 12/31/16 cost 161.2 times the closing price of the S&P 500, and the Dutch Star’s MSRP was 198.94 times the S&P 500.

By 12/31/2021 a new home costs 95.19 times the closing price of the S&P 500, and the Dutch Star’s MSRP is now down to 116.85 times the S&P 500.

So yes, coaches have become even more affordable for those who are retired, and living off their investment portfolios, than those of us who are still working. Again, no big surprise here. As I mentioned in my last video, Quantitative Easing did nothing for the bottom 65% of Americans. From 2008 to today, Quantitative Easing has been a massive stimulus package to assets in general, and the stock market specifically.

Just as a point of interest, the S&P 500 would have to drop to 2,799, or a 41% decline from 12/31/21 closing price of 4,766 before coaches would be as affordable today as they were on 12/31/16.

Now moving on to addressing our last point, which is “I’m going wait and buy a used coach for cheap when all these COVID buyers discover they made a mistake, and want to get out.”

Well it’s been two years since the Pandemic hit, and we’ve not seen any of these COVID buyers regretting the RVing lifestyle. Nor do I think we will see them for two reasons.

First, as I pointed out in my video “RVs, the Economy and You! UPDATE” from June of last year, most of the demand for new coaches was created by a lack of supply. For two months the manufacturers were shut down, and then when they did reopen they were hit with supply chain shortages, and rolling labor shortages due to quarantines. The vast majority of buyers for new coaches were already coach owners, or had been planning and saving to live the lifestyle when they retired. My point, new coach sales went to very few COVID buyers. They went to buyers who were already in the lifestyle, or had planned for years to be in the lifestyle, and those folks aren’t regretting their decisions. Those coaches haven’t, and in my opinion, are not going to be regurgitated back into the market. The notion of being able to purchase a late model, slightly used coach for a steal, hasn’t, and probably isn’t going to pan out.

My second reason is, the COVID buyers who did purchase their first coach because of the Pandemic, did so in a used coach. There were 5 times more used coaches on the market when the Pandemic hit that there were new coaches. And, the ratio hasn’t reversed. There are still more used coaches on the market than new.

As I pointed out in my video last summer, the value of used coaches had skyrocketed when compared to new coach prices. Existing coach owners recognized the arbitrage opportunity, and upgraded, because they already had a coach to upgrade from. They were able to take advantage of the high used coach sales price on their current coach and purchase a brand new one for cheap. On the other hand, COVID buyers purchased used coaches at inflated prices relative to new coaches. And, a much higher percentage of used coach buyers finance their purchases than do new coach buyers.

My point here is, I’m still not seeing the regret among COVID buyers every bargain hunter out there is hoping to see. And, if there is regret among some, unfortunately, they’re trapped. After a two year run, Book Values finally declined in the most recent Book change. Which means, these yet to be seen COVID buyers who are regretting their decisions, are now underwater on their coaches, and will have to write big checks to the bank in order to get out from under their coaches. For those few who may be regretting their decision, I suspect they will find it financially more palatable to just keep making their monthly payments, and learning how to enjoy living the lifestyle, versus writing a big check they probably don’t have. Or, they wouldn’t have financed to begin with.

I would like to close out this series of three videos with some personal thoughts. No data, no numbers, nothing to back what I’m saying up. Just my feelings.

I feel the Fed’s cheap-money policies have essentially created an environment which financializes everything. It encourages companies to buy their competitors instead of innovating, and delivering better products at lower prices. I personally feel that’s unfortunate, and not how a I would like to see a free economy work.

And lastly, I hear almost on a daily basis comments along the lines of “I’ve never seen a trailer hitch on a coffin,” or “I’ve never seen a Brink’s truck in a funeral possession.” For me, I have lived the RVing lifestyle now for 37 years, and for two different reasons.

When the kids were young, I loved the all time we spent together in the coach. I loved having them captive as we drove down the road, and thankfully cell phones didn’t exist for them. We were in our own little world, far away from their friends and from my business, every night in the coach somewhere in our beautiful country. And, now I have those memories to treasure forever. As I look back over my life, I’m so glad I spent both the money and the time to make those memories, because I don’t get a “do over” with my children.

Now as an empty nester I have been fulltiming since 2013 for a different reason. I believe money and power reveal. They often unmask a person. Sometimes we like what is revealed, and many times we don’t. Throughout my career I have spent a fair amount of time around wealthy people, and I haven’t observed an extra dose of happiness in them. Money solves money problems, but it doesn’t make people love you; our actions do. And, that is why I love the RVing lifestyle. There simply isn’t a nicer, more loving community of people out there than RVers, and they truly show it through their actions everyday.

I want to thank all of you for taking the time out of your lives to listen to my thoughts. I hope you come away from these three videos feeling as I do which is, weather change occurs slowly in our lives or if it’s heaped upon a sudden, the sky isn’t falling, for most of us we are financially better off in our lives today after the pandemic than we were before the pandemic. I also hope these three videos will prompt you to look at the world around us in relevant terms and not in absolute. I wish all the best and thank you for watching!