Below is a transcript of his video, and here is a link to the full video explanation.

Greetings National Indoor RV Center’s family of customers and friends.

Yes, I’m back with three more videos, which means three more nights of good sleep for you. And, if you find it difficult to concentrate, and follow my Ben Stein’s “Bueller, Bueller, Bueller” monotone presentation, I do understand. Heck, I put myself to sleep when I have to re-watch myself after the editing is done. Unfortunately, just like a zebra can’t change its stripes, at my age I certainly can’t change mine either. Regardless, I hope you will find the information interesting, educational, and hopefully helpful.

I’d like to start by quoting two lines from Ernest Hemingway’s novel The Sun Also Rises, wherein Bill asks “How did you go bankrupt?” To which Mike responds “Two ways. Gradually, then suddenly.”

Most of us don’t like change, but fortunately, it usually occurs slowly. But, every now and then, events like Pearl Harbor, September 11th, and the Pandemic, come out of nowhere, and change everything suddenly.

With 20/20 hindsight we can look back at those events, and see some clues we just didn’t notice at the time. Change really did occur gradually, and then suddenly.

With the benefit of hindsight, I’d like to take a look at some of the clues which were there for all to see, and share with you some of my observations on 1) how we got to where we are today, 2) where our economy is today, and 3) by knowing where we came from to where we are, should help bring some clarity to what the future may hold for us. Hopefully, this exercise will help set expectations for what we may expect from both our wages, and our investments. Plus, how it may affect our RVing lifestyles, and the prices of coaches in the future. Bottom line, I hope these three videos will help you make more informed decisions in the future.

In this first video titled RVs, the Economy and You! UPDATE #2, Part One, I’ll start with a small primer on the Federal Reserve System. In order to understand prior Monetary Policies, and the actions the Federal Reserve has taken to bring us to where we are today, we will need a modicum of knowledge on how our Federal Reserve System functions.

In Part Two I’d like to delve a little deeper into six topics. And, I do emphasize the word a “little,” because an entire video could easily be devoted to each one of these topics, and it still wouldn’t do them justice. The six topics we’ll discuss in the second video are:

1. Monetary Policy 1 (MP1)

2. Monetary Policy 2, or “Quantitative Easing” (MP2) QE

3. Monetary Policy 3 (MP3), or “Helicopter Money”

4. Supply and Demand

5. Labor Force Participation

6. Stock Market

Topics one through three will cover what has brought us to where we are today, and topics four through six will bring clarity to where we are today. After a basic understanding of these six topics, we’ll cover what they portend for our future in the last video titled RVs, the Economy and You! UPDATE #2, Part Three.

Now let’s get started with our Federal Reserve system. Congress has specified three goals the Federal Reserve, while acting as our central bank, is to achieve. And, these goals are:

1. Maximum employment

2. Stable prices

3. Moderate long-term interest rates

While the Federal Reserve, or “the Fed” for short, has several tools at their disposal, we’ll be discussing just four of the tools it uses to achieve its three goals. These tools are:

1. The Reserve Requirement

2. Their Open Market Operations

3. The Discount Rate

4. The Interest Rate on Excess Reserves

So, how do these four tools work, and how has the Fed used them in the past to get us to where we are today?

Let’s start with the definition of “reserves.” Bank reserves are the minimal amounts of cash a bank is required to keep on hand in case of an unexpected demand. Excess reserves are the additional cash a bank keeps on hand, and for whatever reason, has declined to loan those funds out.

The Federal Reserve sets the Reserve Requirement for banks, which is simply the amount of money banks must keep on hand overnight. Banks can either keep their money in their vaults, or on deposit with the Federal Reserve who is our nation’s Central Bank. When the Fed sets a low reserve requirement it allows our banks to lend out more of their deposits, and is considered expansionary because it creates more credit. Conversely, when the Fed sets a high Reserve Requirement it is considered contractionary, because it results in banks having less money to lend, which constricts credit. It’s worth noting, the Fed rarely changes the Reserve Requirement, because it’s difficult for its member banks to modify their procedures on a dime. So this only occurs at the extremes.

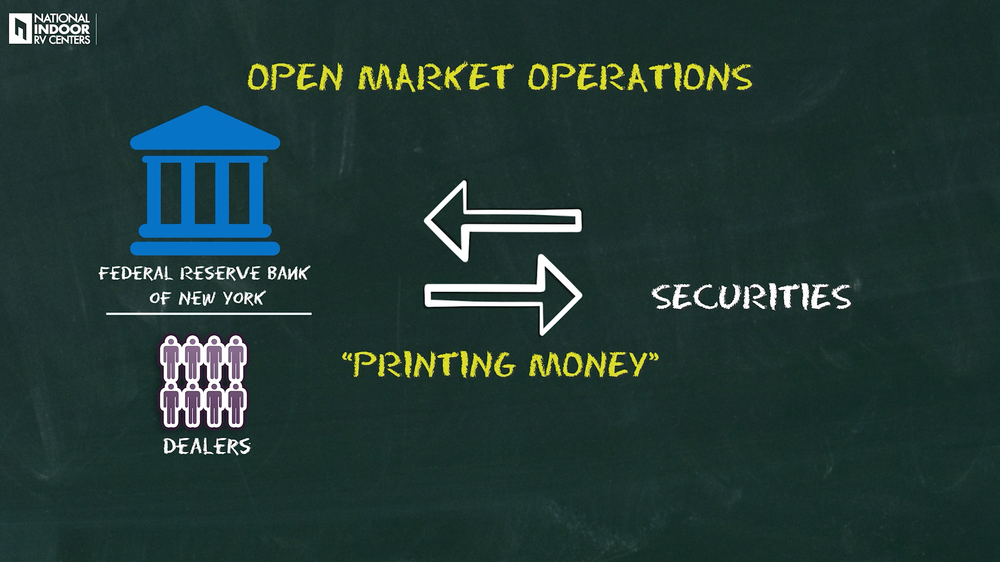

Now, let’s discuss the Fed’s second tool, the Federal Open Market Committee, or the “FOMC.” The FOMC is frequently, if not almost continuously, conducting what’s called “Open Market Operations.” This is the primary tool the Fed uses to adjust our money supply. Prior to the Great Recession of 2008, Open Market Operations were where the Fed purchased and sold only government securities, which included, Treasury Bonds, Treasury Notes, and Treasury Bills.

Now, some of you may be asking; what is the difference between a Treasury Bill, a Treasury Note, and a Treasury Bond? And, the answer is maturities. Treasury Bills have a maturity of one year, or less. Treasury Notes have a maturity of two to ten years, and Treasury Bonds have a maturity of ten to thirty years.

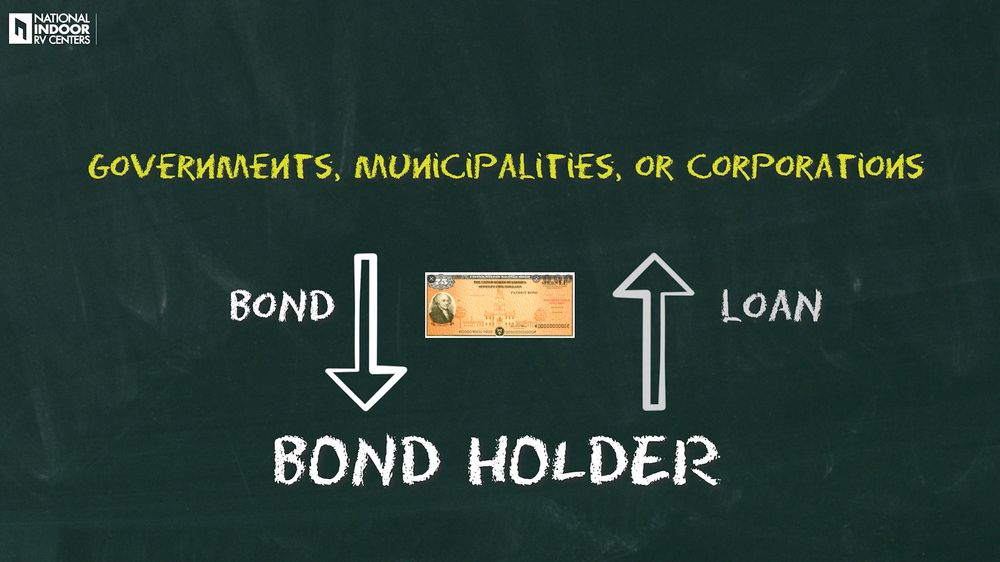

And, for those of you who are unfamiliar with how bonds work, let’s take a minute to review. Bonds are typically issued by governments, municipalities, or corporations when they want to raise money. By buying a bond, you’re giving the issuer a loan, and they agree to pay you back the original face amount of the bond on a specified date, and to pay you periodic interest payments along the way, usually twice a year. Bonds with a fixed-rate coupon pay the same percentage of their face value over time, however, the market price of the bond will fluctuate as the coupon becomes more or less attractive when compared to prevailing interest rates.

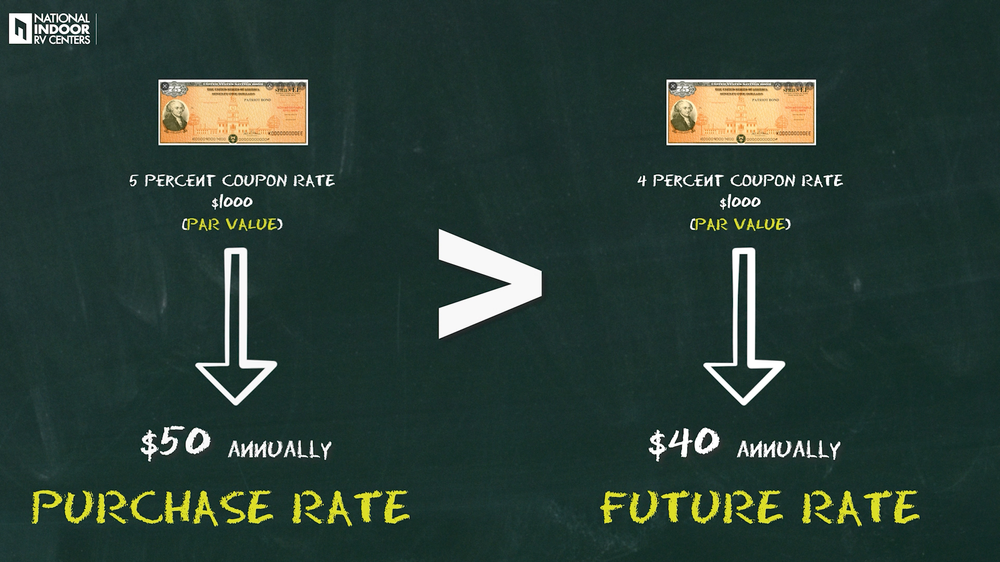

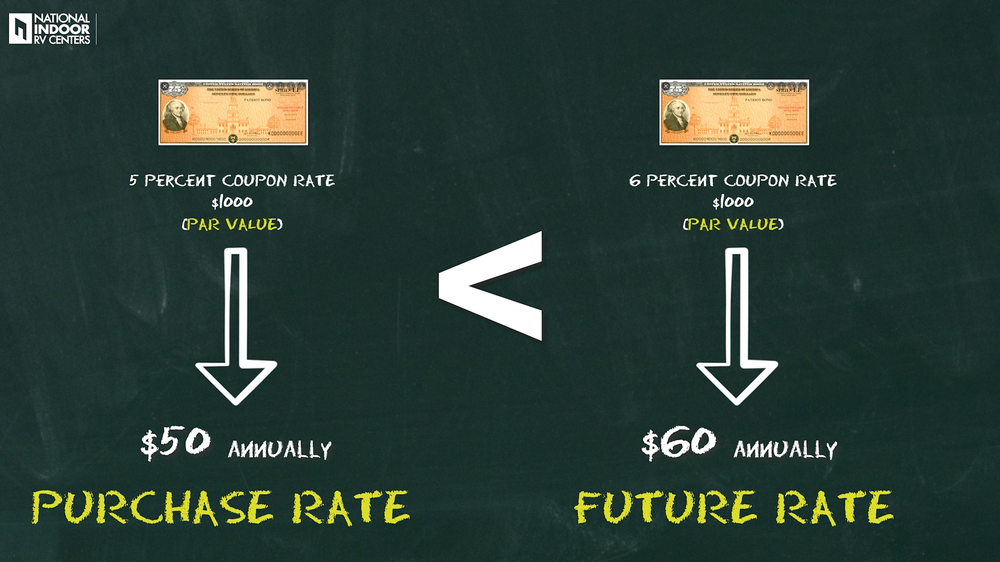

For example, let’s imagine a bond was issued with a coupon rate of 5%, and with a face amount of $1,000, or “par value.” The bondholder will be paid $50 in interest annually. Most bond coupons are split in half and paid semiannually. As long as the interest rate environment doesn’t change, the price of the bond’s par value will remain at its original face amount. But, given bonds are traded every second of every day the interest rate environment is constantly changing.

Let’s assume interest rates begin to decline, and similar bonds are now being issued with a 4% coupon, our original bond has become more valuable. Investors will now have to pay extra for our bond in order to entice us to sell. The increased price brings the bond’s total yield down to 4% for the new investor, because they had to pay an amount above our par value to purchase our bond.

On the other hand, if interest rates rise, and coupon rates for similar bonds are now 6%, our 5% coupon is no longer attractive. Our original bond’s price will decrease, and begin selling at a discount compared to our par value until its effective return is 6%.

Now, getting back to the Fed’s Open Market Operations. All purchases and sales of Treasuries by the Fed, are carried out by the Federal Reserve Bank of New York through its Primary Dealers. When the Fed purchases Treasury Securities, four things happen:

1. Our Central Bank is creating more demand for those Treasuries, which in turn drives their prices higher.

2. As the prices rise the yield on those Treasuries drops, and it has the affect of reducing interest rates across the board of similar maturities.

3. As the Central Bank purchases these Treasury Securities they are taking these securities out of the market place, and replacing them with cash.

4. This new cash, or reserves as they are sometimes called, gives our banks more money to lend.

Now, when our Central Bank is purchasing Securities, it is considered to be an expansionary monetary policy, or the Fed is being accommodative.

When our Central Bank is selling Treasury Securities from their balance sheet, it all happens in reverse:

1. Our Central Bank is adding to the existing supply of Treasury Securities in the market place, which in turn drives their prices lower.

2. As prices drop, the yield on those Treasuries increases, and has the affect of raising interest rates across the board on similar maturities.

3. As the Central Bank sells their Treasury Securities they are adding those securities to the market place, and pulling cash back out of our banking system.

4. This reduction in cash leaves our banks with less money to lend.

When our Central Bank is selling Treasury Securities, it is considered to be executing a tight monetary policy.

This entire process is frequently referred to as “printing money,” because our Federal Reserve, acting as our country’s Central Bank, is the only entity who can buy securities without having cash in their account. Instead, the Fed just credits the selling bank’s account, which is how they have expanded our money supply over time.

Number next, let’s discuss the Fed’s third tool, the Discount Rate. The Discount Rate is the rate our Central Bank charges member banks to borrow at its “Discount Window.” Because the Discount Rate is higher than the Fed Funds rate, banks only borrow at the “Discount Window” if they can’t borrow funds from other banks through what’s called Fed funds. Using the Discount Window has always had a negative stigma attached to it, as the financial community assumes any bank who borrows from the Discount Window is in trouble. After all, only a desperate bank who has been rejected by all other banks in the Fed Funds market would use the discount window.

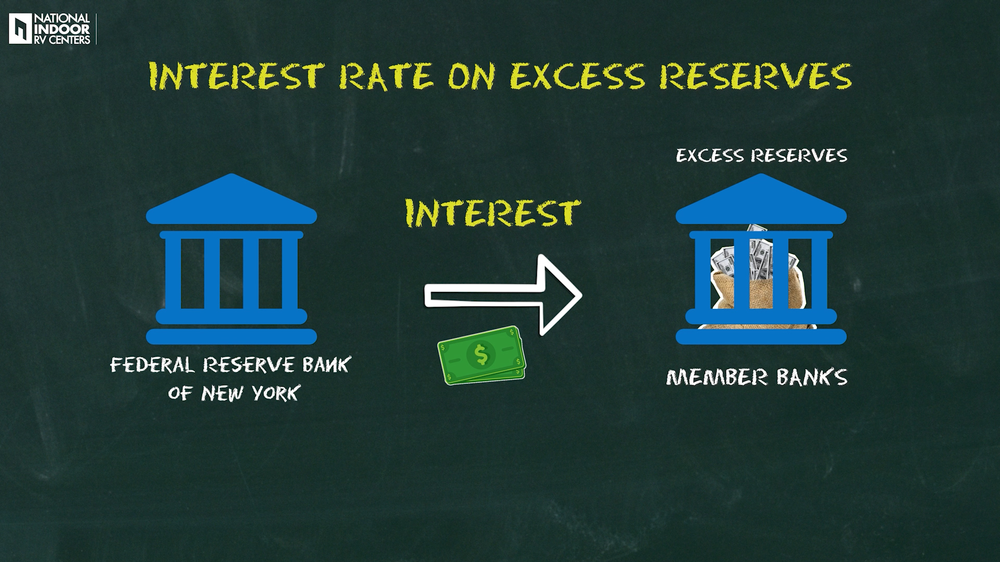

Now for the final tool we will discuss, which is the Interest Rate on Excess Reserves. And, I will confess, I have zero experience with this tool of the Fed, as it didn’t exist back during the years when I owned a bank. Interest Rate on Excess Reserves was created in response to the Great Recession of 2008. Since October 6th, 2008 the Federal Reserve has paid interest on any excess reserves our country’s banks may have on deposit with the Fed. Remember, money always flows to where it’s best treated. So, if the Fed wants banks to lend more money, it lowers the rate it pays on their excess reserves below the rate they can earn by lending. Conversely, if the Fed wants banks to lend less, it raises the rate it pays on their excess reserves.

It’s probably worth noting, interest on excess reserves also supports the Fed Funds rate. And, you’re probably asking how? Well, at the close of business everyday banks either have excess reserves, cash they haven’t lent, or they’re short cash. These excesses and shortages zero themselves out on a nightly basis with overnight Fed Funds. If you’re a bank with excess cash, you want it earning interest at all times. You don’t want your cash sitting idle overnight, because as a bank you are paying interest to your depositors every night. Interest never sleeps. So, you’ll lend your excess cash to other banks who are in need of cash to balance their accounts. These funds are lent through a regional Federal Reserve Bank in what is commonly referred to as “Fed Funds.”

Now, if I’m a bank with excess cash, and the Fed is paying me more for my Excess Cash than other banks are willing to pay through Fed Funds, well I’ll lend my money overnight to the Fed. And, vice versus. If other banks are willing to pay a higher rate than the Fed for my excess cash, then I’ll lend my excess cash to other banks through Fed Funds. So, this is how the Fed uses interest on excess reserves to help support the Fed Funds rate.

Bottom line, the Federal Reserve, acting as our country’s Central Bank, uses the tools we’ve just discussed to increase or decrease our nation’s total liquidity, which is the amount of capital available to invest or lend.

With this little primer on the Federal Reserve under our belt, we can discuss what the impacts have been to our economy as a result of the Fed’s open market operations over the past 14 years in RVs, the Economy and You! UPDATE #2, Part Two video.

Thank you for listening to my ramblings, and if you’re still awake, I’ll continue my musings in the next video.